SPONSORSHIP

Contribute to the development of an artistic heritage by becoming a sponsor or patron

By associating their names with those of recognised cultural institutions, companies benefit from substantial advantages thanks to the provisions of the law of 1 August 2003-709 in favour of sponsorship: a reduction in corporation tax of 60% of the amount of the donation (up to a ceiling of 0.5% of the company's turnover), and material rewards up to 25% of the donation.

Thus, for a donation of €10,000, the company can deduct €6,000 and benefit from €2,500 in advantages (receptions, use of the auditoriums, admission to the museums).

Informations

Martine Guichard - Kirschleger

Patronage and Sponsorship Officer

National museums of the 20th century in the Alpes-Maritimes

e-mail : mgkconseils@gmail.com

associated.content.title

The Chagall Museum member of the Plein Sud network

The visual arts network of the South of France

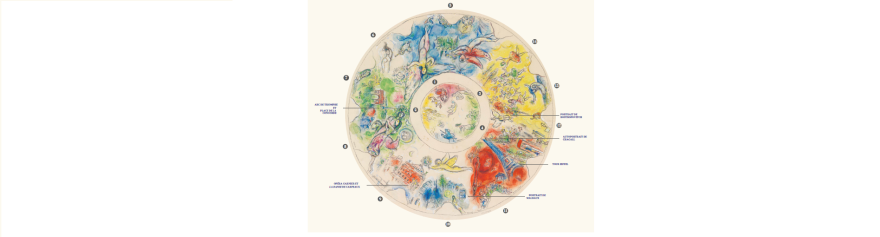

Self-guided Tour of Six Marc Chagall Mosaics on the Côte d'Azur

As part of the exhibition Glass and stone. Chagall in mosaic from May 24 to September 22, 2025.

Dispositivo Esplicativo per il Soffitto dell'Opera di Parigi

Il tributo di Chagall alla musica e a Parigi